Tesla reported a 9% drop in first-quarter revenue on Tuesday, the biggest decline since 2012, and missed analysts’ estimates, as the electric vehicle company weathers the effect of ongoing price cuts.

The stock jumped in extended trading after CEO Elon Musk told investors that production of new affordable EV models could begin sooner than expected.

This is the very thing the organization revealed contrasted and what Money Road was anticipating, in light of a study of examiners by LSEG:

Profit per share: 45 pennies changed versus 51 pennies anticipated

Income: $21.30 billion versus $22.15 billion anticipated

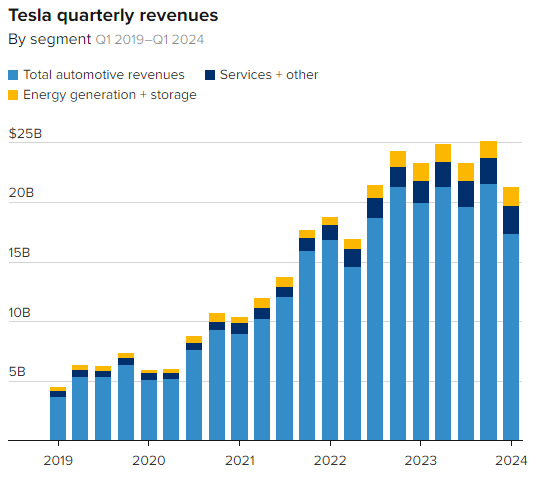

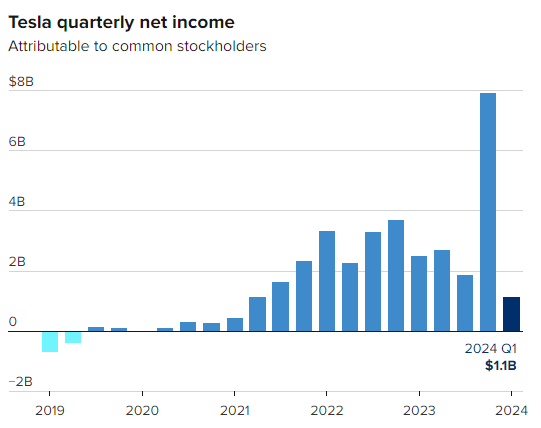

Income declined from $23.33 billion a year sooner and from $25.17 billion in the final quarter. Net gain dropped 55% to $1.13 billion, or 34 pennies an offer, from $2.51 billion, or 73 pennies an offer, a year prior.

The drop in sales was even steeper than the company’s last decline in 2020, which was due to disrupted production during the Covid-19 pandemic. Tesla’s automotive revenue declined 13% year over year to $17.38 billion in the first three months of 2024.

Musk said on the call that the company plans to start production of new models in “early 2025, if not late this year,” after previously expecting to begin in the second half of 2025. Musk also touted Tesla’s investments in artificial intelligence infrastructure, and said the company is in talks with “one major automaker” to license its driver assistance system, which is marketed in the U.S. as the Full Self-Driving, or FSD, option.

In its shareholder deck, Tesla reiterated a pessimistic outlook for 2024, telling investors that “volume growth rate may be notably lower than the growth rate achieved in 2023.”

models in “early 2025, if not late this year,” after previously expecting to begin in the second half of 2025. Musk also touted Tesla’s investments in artificial intelligence infrastructure, and said the company is in talks with “one major automaker” to license its driver assistance system, which is marketed in the U.S. as the Full Self-Driving, or FSD, option.

In its shareholder deck, Tesla reiterated a pessimistic outlook for 2024, telling investors that “volume growth rate may be notably lower than the growth rate achieved in 2023.”

Prior to the 11% jump after hours, Tesla shares were down more than 40% this year, reaching their lowest since January 2023, on concerns about weak deliveries, competition in China and the company’s ongoing price cuts.Recently, Tesla detailed a 8.5% year-over-year decrease in vehicle conveyances for the principal quarter.

The company said in the deck that it’s accelerating the launch of “new vehicles, including more affordable models,” that will “be able to be produced on the same manufacturing lines” as Tesla’s current lineup. Tesla is aiming to “fully utilize” its current production capacity and to achieve “more than 50% growth over 2023 production” before investing in new manufacturing lines.

Also in the deck, Tesla showed off screens of a robotaxi-based ride-hailing service. The company has been promising a self-driving vehicle for years without delivering on Musk’s promise.

Sales growth across EVs is slowing, and Tesla and key rivals have been slashing EV prices to try to spur demand. Tesla’s gross profits plummeted 18% in the first quarter, partly due to price cuts this year.

After discussing operational challenges in the first quarter, including Red Sea supply chain disruptions, Musk said on the call that, “We think Q2 will be a lot better.”

Tesla said total sales included revenue from earlier sales of its FSD option. The release of a feature called Autopark in North America allowed the company to recognize the deferred revenue.

Chris Redl, autos analyst at Siena Capital, estimates that Tesla recognized as much as $700 million in deferred revenue in the quarter from FSD. That’s roughly 4.3% of Tesla’s automotive revenue after stripping out regulatory credits.

Tesla embarked on a massive restructuring this month, with two executives, Drew Baglino and Rohan Patel, resigning.Musk said last week in a companywide notice that the automaker was cutting over 10% of its worldwide labor force.

Capital expenditures rose to $2.77 billion, up 34% from a year earlier.

Free cash flow turned negative in the quarter, with the company reporting a deficit of $2.53 billion. A year ago, Tesla reported free cash flow of $441 million, a number that reached $2.06 billion in the fourth quarter. Tesla attributed the negative figure to a $2.7 billion buildup in inventory and $1 billion in capital expenditures on “AI infrastructure.”

Revenue in Tesla’s energy division increased 7% to $1.64 billion, while services and other revenue rose 25% to $2.29 billion compared to the same period last year.

Musk was asked on the earnings call if he has any intention to leave Tesla given his many jobs, including leading SpaceX, controlling X (formerly Twitter) and running other businesses.

Musk didn’t provide an answer, but said he spends the majority of his time at work, rarely even takes off a Sunday afternoon and will work to make sure Tesla is “very prosperous.”