Facebook Parent Company Meta Loses $322 Billion Overnight: What Happened?

Table of Contents:

Introduction

Meta Stock Crash Explained

Impact on Facebook and Meta

What’s Next for Meta?

Conclusion

Introduction:

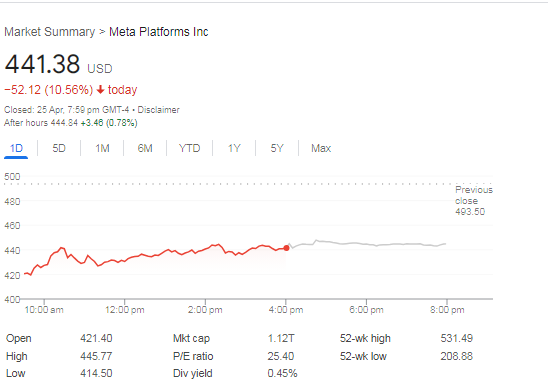

In a stunning new development, the parent organization of Facebook, Meta, encountered an enormous securities exchange crash, bringing about a stunning deficiency of $322 billion short-term. The Meta stock cost plunged, sending shockwaves through the monetary business sectors and tech industry the same. How about we dig into what prompted this remarkable occasion and its suggestions.

Meta Stock Crash Explained:

The Meta stock decline happened because of a blend of elements, including disheartening profit reports, administrative difficulties, and worries over the future development possibilities of the organization. Financial backers responded quickly to these turns of events, prompting an auction of Meta’s portions and a sharp decrease in its fairly estimated worth.

Impact on Facebook and Meta:

The repercussions of the Meta stock decline are critical for both Facebook and its parent organization. The unexpected deficiency of $322 billion in market capitalization has brought up issues about the steadiness and long haul suitability of Meta’s plan of action. The organization’s promoting income, which frames the center of its activities, has gone under examination, as sponsors might reexamine their associations with Meta considering the securities exchange disturbance.

What’s Next for Meta?

Proceeding, Meta faces an overwhelming test in reestablishing financial backer certainty and revamping its fairly estimated worth. The organization’s administration group should carry out essential drives to resolve the hidden issues that encouraged the stock decline. This might include differentiating income streams, improving client commitment, and exploring the complex administrative scene that oversees the tech business.

Conclusion:

The Meta stock decline fills in as a useful example for tech organizations working in the present unstable market climate. The abrupt and sensational misfortune in market esteem highlights the significance of strong gamble the executives rehearses and proactive correspondence with partners. As Meta outlines a course for the future, it should focus on straightforwardness, development, and responsibility to recover the trust of financial backers and clients the same.

All in all, the Meta stock decline helps us to remember the innate dangers and vulnerabilities in the tech business, where fortunes can change for the time being. By gaining from this experience, Meta can arise more grounded and stronger despite affliction. Remain tuned for additional reports on the repercussions of the Meta stock slump and its suggestions for the more extensive tech biological system.

Published by Projobsadda